Startup Accounting Basics: 6 Confusing Accounting Terms

6 Confusing Accounting Terms

Part 4 of a 10 Part Series

Accounting for Small Business 101

This 10 part guide will provide you with the most basic fundamentals of accounting for your business. Whether you’re a budding entrepreneur with your first start-up or a stay-at-home mom selling knit hats on Instagram, lay the groundwork. Here’s how.

Part 4: The Language of Accounting - 6 Confusing Terms

We’ve covered the crucial basics of what accounting is, who to hire to do your accounting, and the 4 fundamental documents. Now let’s broaden your vocabulary so you can have meaningful conversations with your accountant.

In the world of accounting, there are many terms and vocabularies that seem like a whole other language. As a regular consumer, we’re familiar with terms like “debit card” and “bank account”. But the words debit and account have unique meanings in accounting. The accounting language learning curve can feel as steep as Duolingo lessons. But understanding these terms can help you communicate with your accountant and be a better business owner.

Here are 6 of the most confusing accounting terms. We’ll break them down and translate them as simply as possible.

Cash

What it means to us

Paper money, Dollar bills.

Example:

Jim: Hey bro, can you venmo me for your half of lunch?

Darryl: Let me just give you cash, I have a twenty in my wallet.

What it means to an accountant

Paper bills, coins, bank balances, money orders, and checks. Any form of currency or assets that are easily accessible and can be quickly turned into physical cash within one year.

Example:

Stanley owns a pizza place. He has $10,000 in his bank, checks from customers totaling $500, $1,000 in paper bills and coins in the till, $200 worth of pizza ready to sell, and a delivery van valued at $12,000. This is all considered cash.

Books

What it means to us

Those papery things that you read. Or have downloaded on your kindle or phone or tablet or e-reader.

Example:

Pam: Do you like to read books?

Kelly: No. Too many words hurts my brain. I prefer Tiktok.

What it means to an accountant

The “books” that your bookkeeper is keeping is also called a ledger. It’s a collection of all your transactions, organized into accounts (another confusing term, see below). In the olden days when manual accounting was done, this was an actual book with separate pages (or ledger sheets) for each account. Nowadays we use software systems as our books. That’s why it’s called Quickbooks.

Accounts

What it means to us

A bank account, such as a checking account or savings account. Or an online account that stores our info on a website.

Example: I logged into my Citibank account to check my bank accounts. I won’t be able to transfer to my savings account this month because my checking account is shockingly low.

What it means to an accountant

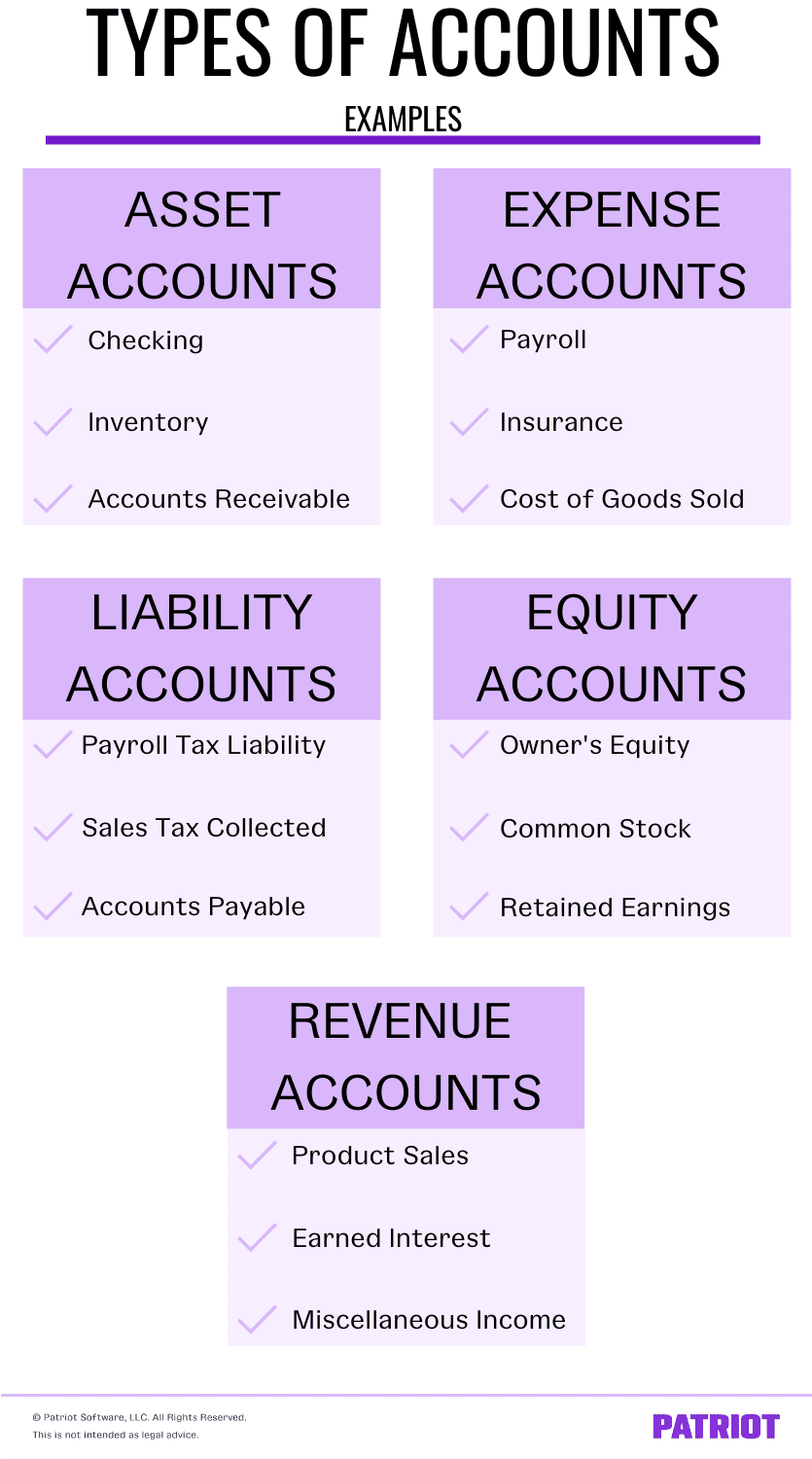

Accounts are records used for organizing transactions. Think of your books as a filing cabinet. There are 5 drawers which hold different kinds of accounts: Asset accounts, Expense accounts, Liability accounts, Equity accounts, and Revenue (Income) accounts. Within each drawer are tabbed file folders which are sub-accounts. They hold and organize all your transactions. Check out the graphic below for a breakdown of the different kinds of accounts.

Income

What it means to us

Paychecks from our employer. The stuff we have to pay income taxes on. It’s the money that comes into our checking account and then swiftly leaves after payday.

Example: Michael is working on his budget. He just got a raise, so his income will be an extra $250 a month. He excitedly raises his candle budget to $300/month.

What it means to an accountant

Income = Revenue - Expenses. Income is the bottom line of an Income Statement. An Income Statement is a document that shows how much revenue was earned and how many expenses were incurred. It does not report the money coming into the business bank account. Income is the profitability of the business.

Example: Oscar deposited $10,000 in his business bank account this month, but his salsa company’s expenses were the same as its revenue. His income statement shows $0 in income this month.

Debits and Credits

What it means to us

A debit card is what you use when shopping and you’re comfortable with your bank account balance going down immediately. A credit card is what you use when you’re unsure your bank account has enough money in it. Or maybe you just want to collect those sweet, sweet credit card rewards points.

Example: You’re getting gas and swipe your card. The screen says “debit or credit?” You choose one at random because you’re not sure what the difference is.

What it means to an accountant

In accounting jargon, debit and credit are terms derived from ancient Latin. Debit simply means left, and credit means right. When bookkeeping, every transaction has a column for debit on the left and a column for credit on the right. Debits are an increase, a positive number. And credits are a decrease, a negative number. To debit an account is to add funds. To credit an account is to remove funds.

Example: Angela received $20 in cash from Meredith for her purchase of a bedazzled cat collar. Angela records the transaction and debits (increases) the Cash account $20, and credits (decreases) the Sales account $20.

There are many more words in accounting vocabulary that help you fully understand the financial state of your business. The right accountant will help teach you what you need to know to benefit your business. For an accounting team that is always there for you, reach out to Pioneer Accounting Group.